When you're planning a move, there are a lot of things to think about - including the tax implications. If you're moving to Texas, you'll want to be aware of the state's capital gains tax. And if you're an investor, there are other tax implications to consider as well. Here's what you need to know about capital gains tax in Texas and other important tax considerations for your move.

TABLE OF CONTENTS

What are Capital Gains Tax?

Capital Gains Tax is a tax system that takes into consideration the income generated from investments and other property. Generally, these capital gains are taxed differently than normal income, typically at lower rates because of the assumed risk involved with such activities.

For example, when selling a house, the difference between the purchase price and sale price is considered capital gain and is liable to taxation according to applicable government regulations. Capital Gains Tax can also be liable in certain investment or business transactions depending upon their impact on the revenue of a country or state. Therefore, understanding Capital Gains Tax is important if one desires to be proactive about their finances and legal obligations.

For informational purposes only. Always consult with a tax specialist before proceeding with any transaction.

Types of Capital Gains

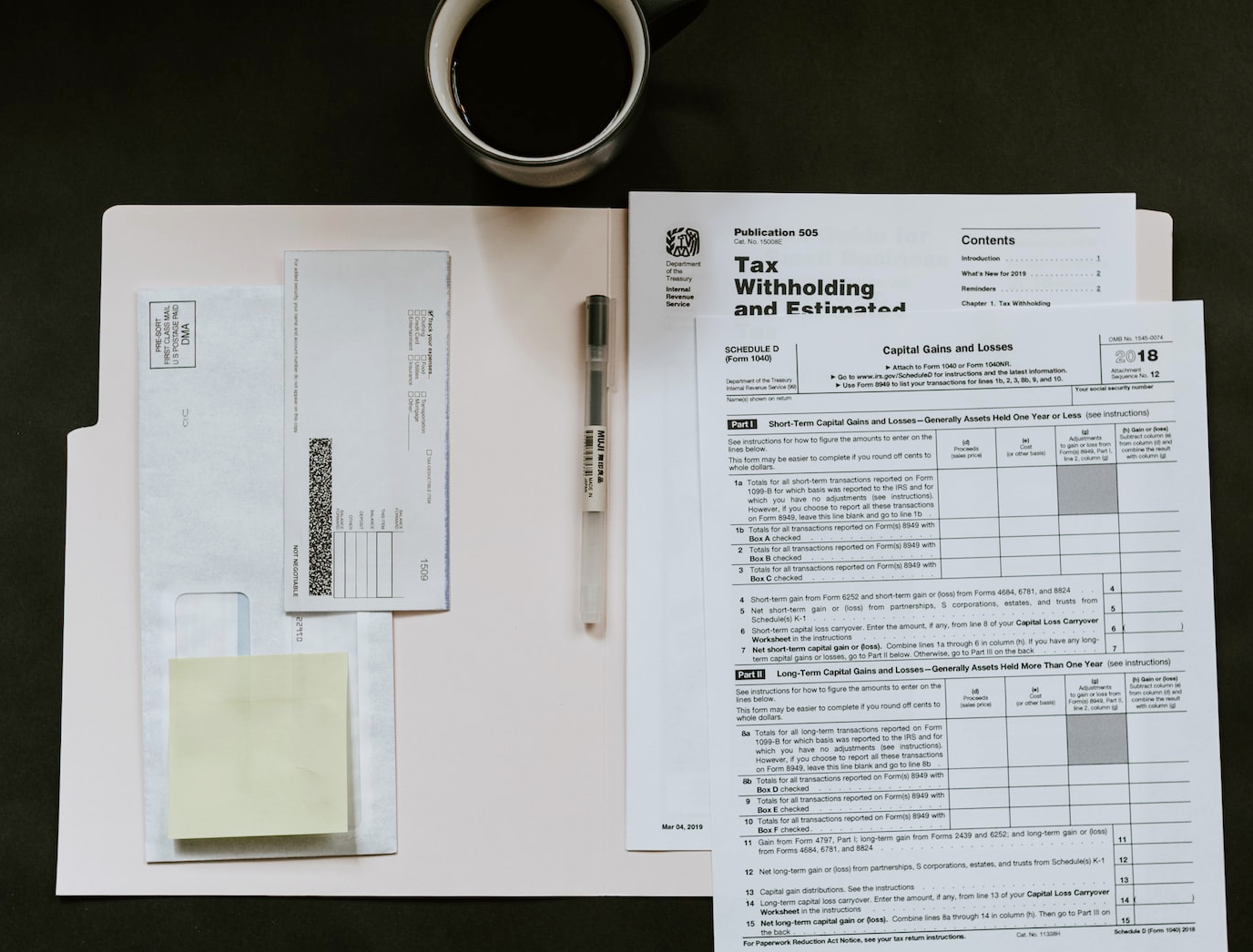

Capital gains are subject to taxation, and the tax rate applied to capital gains depends on the type of gain and the holding period of the asset. Two types of capital gains are short-term and long-term.

Short-term capital gains are realized from the sale of an asset that was held for one year or less, and are taxed at the individual's marginal income tax rate, which is the rate at which the last dollar of income is taxed.

Long-term capital gains, on the other hand, are realized from the sale of an asset that was held for more than one year and are typically taxed at a lower rate than short-term gains, it depends on the tax laws of the jurisdiction and the specific tax bracket of the individual.

Does Texas Have Capital Gains Tax?

Texas does not have a state income tax, which means that residents of the state do not pay capital gains taxes on investments. Instead, federal taxation applies to all investment transactions in Texas as it does anywhere else in the United States.

However, while Texas has no statewide capital gains tax rate, investors should still be aware of any local taxes they may incur on investments and check with their city or county for more detailed information. Additionally, taxpayers must file federal tax returns if they've bought or sold stocks, bonds, mutual funds, or other investments during the year, even if they live in a state without capital gains taxation like Texas.

Sign Up for free Get the first to receive the latest listing updates, save favorites & much more by signing up.

If you already have in account, SIGN IN.

How Do I Avoid Capital Gain Taxes in Texas?

In Texas, it's relatively easy to abstain from capital gains taxes since the state has no income tax and consequently doesn't impose any capital gains tax either. There are several ways to potentially minimize capital gain taxes in Texas, or any other state, including:

For informational purposes only. Always consult with a tax specialist before proceeding with any transaction.

1. Holding the Asset for a Long-term Period

Holding the asset for a long enough period of time so that it qualifies for the long-term capital gains tax rate, which is generally lower than the short-term rate.

2. Capital Gains Tax Exemptions and Exclusions

Taking advantage of capital gains tax exemptions or exclusions. If you're you an individual with a yearly income below $40,400 or a married couple earning less than $80,800, as long as your property is held for more than 12 months, you will pay 0% Capital Gains Taxes. This applies to widows and widowers too.

3. Investing in Tax-Advantaged Retirement Accounts

Investing in tax-advantaged retirement accounts, such as traditional IRAs or 401(k)s, which can help to defer or eliminate capital gains taxes on the money invested in them.

4. Investing in Assets with Special Tax Treatment

Investing in assets that receive special tax treatment, such as collectibles or some types of real estate.

5. Utilizing a 1031 Exchange

Utilizing a 1031 exchange allows you to defer paying capital gains taxes on the sale of an investment property by using the proceeds to purchase a "like-kind" property.

It is important to note that the specific tax laws and regulations that apply to you may vary depending on your individual circumstances, and it is always recommended to consult a tax professional to understand how to legally minimize the capital gains tax for your specific situation.

Taxes to Consider When Moving

When looking to move, it's important to consider more than just the cost of relocating. Different states and cities may have different taxes that could significantly impact your overall expenses.

Moving from one state to another can have significant tax implications, and it's important to consider these before making the move. Some of the key tax implications to consider when moving from one state to another include:

For informational purposes only. Always consult with a tax specialist before proceeding with any transaction.

1. State Income Tax

Some states have a state income tax, while others do not. If you're moving to a state with a higher income tax rate, your overall tax burden may increase.

2. Sales Tax

Sales tax rates can also vary widely between states. If you're moving from a state with a low sales tax rate to one with a higher rate, you'll need to factor that into your budget.

3. Property Tax

Property tax rates can vary significantly between states and are generally based on the value of your property. If you're moving to a state with higher property tax rates, that could increase your overall housing costs.

4. Tax Laws and Regulations

Every state has its own set of tax laws and regulations, and it's important to familiarize yourself with the tax code of the state you're moving to. Some states offer more generous tax breaks for certain expenses, like mortgage interest, while others may not.

5. Changes in Your Filing Status

Your filing status may change based on your new state of residence and the laws and regulations of that state.

6. Reciprocity Agreement

Some states have reciprocal agreements which means they have an agreement to not tax the income earned in the other state. This agreement may not be there with the state you are moving to and you may have to file taxes to the state you are moving from and the state you are moving to.

Understanding how much money you may need to plan for throughout the year is an important step in making a successful move. It's important to consult with a tax professional or research the tax laws of the state you're moving to, to ensure that you're aware of any potential changes and are able to plan accordingly.

Capital Gains Tax in Texas

There are a lot of taxes to take into consideration when moving - not just capital gains tax. Be sure to factor in things like income tax, property tax, and sales tax so you're not hit with a big bill later on.

If you're considering making the move to Austin, click here to speak to a real estate consultant. Our team of experts can help you plan everything out and make sure the transition is as smooth as possible.

The contents of this blog are for informational purposes only and should not be taken as legal or tax advice. You should consult a licensed professional for advice on your specific situation. The information in this blog may be changed without notice and is not guaranteed to be complete, correct, or up-to-date. This blog is not intended to be a substitute for professional advice.

Leave A Comment